SECURITIES AND EXCHANGE COMMISSION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒x Filed by a Party other than the Registrant ☐¨ Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to Section 240.14a-12 |

¨Preliminary Proxy Statement

¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨Definitive Additional Materials

¨Soliciting Material Pursuant to Section 240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

x No fee required

¨Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

| | | | |

(1) | | Title of each class of securities to which transaction applies:

| | | | | | | |

(2) | | Aggregate number of securities to which transaction applies:

| | |

(3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | |

(4) | | Proposed maximum aggregate value of transaction:

| | |

(5) | | Total fee paid:

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(2) Aggregate number of securities to which transaction applies:

| | | | |

(1) | | Amount Previously Paid:

| | | | | | | |

(2) | | Form, Schedule or Registration Statement No.:

| | |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨Fee paid previously with preliminary materials.

¨Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

June 14, 2017

March 13, 2020

You are cordially invited to join us for our

20172020 annual meeting of stockholders, which will be held on

Wednesday, July 26, 2017,Thursday, April 23, 2020, at 10:30 am ET, at Greenhill & Co., Inc., 300 Park Avenue, New York, New York 10022. Holders of record of our common stock as of

May 31, 2017March 3, 2020 are entitled to notice of, and to vote at, the

20172020 annual meeting.

The

attached Notice of Annual Meeting of Stockholders and

the proxy statement that followProxy Statement describe the business to be conducted at the meeting.

We also will report on matters of current interest to our stockholders.We hope you will be able to attend the meeting. However, even

Even if you plan to attend

the meeting in person, please vote your shares promptly to ensure they are represented at the meeting. You may submit your proxy vote by completing and signing the enclosed proxy card and returning it in the envelope provided. If you decide to attend the meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting. Stockholders of record also have the option of voting their shares via the

Internet.Internet or by telephone. Instructions on how to vote via the Internet

or by telephone are on the proxy card.

If

Thank you for your

shares are held in the namecontinued support of

a broker, bank, trust or other nominee, you will need proof of ownershipGreenhill. Your vote is important to

be admitted to the meeting and a valid proxy to vote at the meeting, as described under “How can I attend the meeting?” on page 3 of the proxy statement.Weus; we look forward to seeing you at the annual meeting.

Even if you do not plan to attend the meeting in person, we hope your votes will be represented.

Sincerely,

Scott L. Bok

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| Date and Time: | | Wednesday, July 26, 2017Thursday, April 23, 2020 at 10:30 a.m., Eastern Time |

| |

| Place: | | Greenhill & Co., Inc.

300 Park Avenue

New York, New York 10022

|

| |

| Items of Business: | | 1. The election of directors.six directors to serve until the 2021 annual meeting of stockholders. |

| |

| 2. An advisory resolution to approve executive compensation (Say on Pay). |

| |

| | 2. Advisory vote to approve named executive officer compensation. |

| |

| | 3. Advisory vote on the frequency of future advisory votes to approve named executive officer compensation. |

| |

| | 4. The ratification of the selectionappointment of Ernst & Young LLP as Greenhill’s independent auditorsour registered public accounting firm for the year ending December 31, 2017.2020. |

| |

| 4. The consideration of a stockholder proposal, if properly presented by the stockholder proponent |

| |

| | 5. Any other business that may properly be considered at the meeting or at any adjournment of the meeting. |

| |

| Record Date: | | You may vote if you were a stockholder of record at the close of business on May 31, 2017.March 3, 2020. |

| |

Voting by Proxy, or via the Internet: | Internet or by telephone: | Whether or not you plan to attend the annual meeting in person, please vote your shares by proxy or via the Internet or by telephone to ensure they are represented at the meeting. You may submit your proxy vote by completing, signing and promptly returning the enclosed proxy card by mail. Instructions on how to vote via the Internet or by telephone are on the proxy card. |

| Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on April 23, 2020: | Our Proxy Statement and 2019 Annual Report, which includes our Form 10-K for the fiscal year ended December 31, 2019 and other materials are available free of charge on our website at: https://www.greenhill.com/investor/report. On or around March 13, 2020, we will have sent to certain of our stockholders a notice of Internet Availability of Proxy Materials (“Notice”), which includes instructions on how to access our Proxy Statement and 2019 Annual Report to Stockholders and vote online. Stockholders who do not receive the Notice will continue to receive either a paper or an electronic copy of our proxy materials, which will be sent on or around March 13, 2020. For more information, see Frequently Asked Questions. |

By Order of the Board of Directors

Ricardo Lima

Gitanjali Pinto Faleiro

General Counsel & Corporate Secretary

TABLE OF CONTENTS

Greenhill & Co., Inc. (which we refer to as “Greenhill”, “we”, the “Company” or the “Firm” in this proxy statement) is soliciting proxies for use at the annual meeting of stockholders to be held on

July 26, 2017April 23, 2020 and at any adjournment or postponement of the meeting. This proxy statement and the enclosed proxy card are first being mailed or given to stockholders on or about

June 14, 2017.March 13, 2020.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the meeting?

At our annual meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders. These include the election of directors, an advisory

voteresolution to approve our

named executive officer compensation,

an advisory vote on the frequencyconsideration of

future advisory votes to approve our named executive officer compensationa stockholder proposal, if properly presented, and the ratification of the

selectionappointment of our independent

auditors. Also, management will report on matters of current interest to our stockholders and respond to questions.auditor.

Who is entitled to vote at the meeting?

The Board has set

May 31, 2017,March 3, 2020, as the record date for the annual meeting. If you were a stockholder of record at the close of business on

May 31, 2017,March 3, 2020, you are entitled to vote at the meeting. As of the record date,

29,605,10618,771,782 shares of common stock were issued and outstanding and, therefore, eligible to vote at the meeting.

What are my voting rights?

Holders of our common stock are entitled to one vote per share. Therefore, a total of

29,605,10618,771,782 votes are entitled to be cast at the meeting. There is no cumulative voting.

How many shares must be present to hold the meeting?

In accordance with our bylaws, holders of a majority of the outstanding shares of common stock entitled to vote at a meeting of stockholders must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if:

•you are present and vote in person at the meeting;

•you have properly submitted a proxy card by mail; or

•you have properly voted via the Internet.Internet or by telephone.

How do I submit my proxy vote?

If you are a stockholder of record, you can give a proxy to be voted at the meeting by completing, signing and mailing the enclosed proxy card.

If you hold your shares in “street name,” you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee. Your broker, bank, trust or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker, bank, trust or nominee how to vote your shares.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or otherwise by a broker, bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described above under “How do I submit my proxy vote?”

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card you receive.

How do I vote via the

Internet?Internet or by telephone?

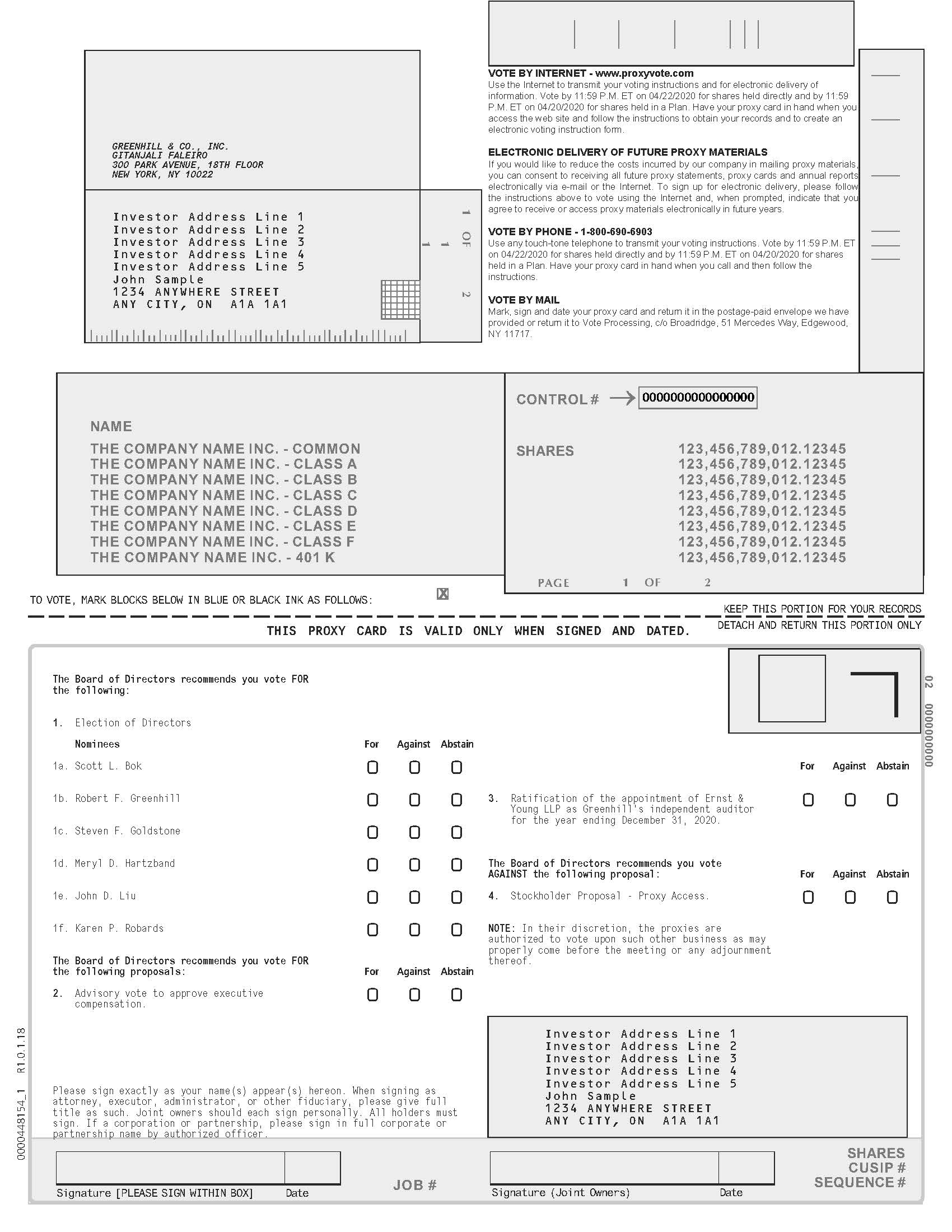

Internet and telephone voting information is provided on the proxy card. A control number, which is the number located below the account number on the proxy card, is designated to verify a stockholder’s identity and allow the stockholder to vote the shares and confirm that the voting instructions have been recorded properly.If you vote via the Internet or by telephone, please do not return a signed proxy card.Stockholders who hold their shares through a bank or broker can vote via the Internet or by telephone if that option is offered by the bank or broker.

Can I vote my shares in person at the meeting?

If you are a stockholder of record, you may vote your shares in person at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting. If you submit your vote by proxy and then decide to vote in person at the annual meeting, the vote you submit at the meeting will override your proxy vote.

If you are a street name holder, you may vote your shares in person at the meeting only if you obtain and bring to the meeting a signed letter or other proxy from your broker, bank, trust or other nominee giving you the right to vote the shares at the meeting.

What vote is required for the election of directors

orand for the other proposals to be approved?

The approval of a plurality of the affirmative votes cast at the meeting, even if less than a majority, is required for the election of directors.

The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting is required to approve the

nominees for director, executive compensation advisory vote,

on named executive officer compensation, to approve the advisory vote on the frequency of future advisory votes to approve named executive officer compensation, and to ratify the

selectionappointment of our independent

auditors.auditor.

How are votes counted?

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors.

You may vote “FOR”, “AGAINST” or “ABSTAIN” on

the other proposals. The advisory votes to approve named executive officer compensation and to approve the frequency of future advisory votes to approve named executive officer compensation, as well as the ratification of the selection of Ernst & Young LLP as independent auditor, are not binding on the Board of Directors, but we value your votes and will consider the results carefully.each proposal.

If you submit your proxy or vote via the Internet

or by telephone but abstain from voting on one or more matters or withhold authority to vote, your shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the quorum if you attend, even if you abstain from voting or withhold authority to vote.

Other than for the election of directors, if you abstain from voting on a proposal, your abstention has the same effect as a vote against that proposal.

Broker non-votes will have no effect and will not be counted towards the vote total for any proposal.

What are “Broker Non-Votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still use its discretion to vote the shares with respect to matters that are considered to be “routine,” such as the proposal to ratify the

selectionappointment of our independent

auditors,auditor, but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange

(“NYSE”), “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors, even if not contested,

and advisory votes on executive

compensation, advisory votes on the frequency of future advisory votes on executive compensation and the approval of an equity incentive plan.compensation. Broker non-votes are counted toward a quorum.

Therefore, if member brokers do not receive instructions from the beneficial owner of the shares, they may only vote on the proposal to ratify the

selectionappointment of our independent

auditors.auditor. We therefore urge you to give voting instructions to your broker on all proposals.

How does the Board recommend that I vote?

The Board of Directors recommends a vote:

•FOR all of the nominees for director;

•FOR the executive compensation advisory vote to approve our named executive officer compensation;vote;

•FOR a frequency of everyONE year for future advisory votes to approve our named executive officer compensation; and

FOR the ratification of the selectionappointment of Ernst & Young LLP as Greenhill’s independent auditorsauditor for the year ending December 31, 2017.2020; and

•AGAINST the stockholder proposal.

What if I do not specify how I want my shares voted?

If you submit a signed proxy card or vote via the Internet

or by telephone but do not specify how you want to vote your shares, we will vote your shares:

•FOR all of the nominees for director;

•FOR the executive compensation advisory vote to approve our named executive officer compensation;vote;

•FOR a frequency of everyONE year for future advisory votes to approve our named executive officer compensation; and

FOR the ratification of the selectionappointment of Ernst & Young LLP as Greenhill’s independent auditorsauditor for the year ending December 31, 2017.2020; and

•AGAINST the stockholder proposal.

Can I change my vote after submitting my proxy?

Yes. Whether you vote by mail,

or via the Internet

or by telephone, you may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting in any of the following ways:

•By sending a written notice of revocation to the Secretary of Greenhill;Greenhill, attention General Counsel & Corporate Secretary;

•By submitting a later-dated proxy;

•By voting via the Internet or by telephone at a later time; or

•By voting in person at the meeting.

Will my vote be kept confidential?

Yes. We have procedures to ensure that, regardless of whether stockholders vote by mail, via the Internet or in person, (1) all proxies, ballots and voting tabulations that identify stockholders are kept confidential, except as disclosure may be required by federal or state law or expressly permitted by a stockholder; and (2) voting tabulations are performed by an independent third party.

How can I attend the meeting?

You may be asked to present valid picture identification, such as a driver’s license or passport, before being admitted to the meeting. You also will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from your broker, bank, trust or other nominee are examples of proof of ownership.

Please let us know if you plan to attend the meeting when you return your proxy by marking the attendance box on the proxy card.

Who pays for the cost of proxy preparation and solicitation?

Greenhill pays for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or other nominees for forwarding proxy materials to street name holders. We have also hired Georgeson Inc. to assist in the solicitation

and distribution of proxies, for which they will receive a fee of $13,500, as well as reimbursement for certain out-of-pocket costs and expenses.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

Pursuant to the SEC “Notice and Access” rules, we are furnishing our proxy materials to our stockholders over the Internet instead of mailing each of our stockholders paper copies of those materials. As a result, we will send such stockholders by mail or e-mail a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, containing instructions on how to access our proxy materials over the Internet and how to vote. The Notice is not a ballot or proxy card and cannot be used to vote your shares of common stock. You will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice or on the website referred to on the Notice. If you own shares of common stock in more than one account — for example, in a joint account with your spouse and in your individual brokerage account — you may have received more than one Notice. To vote all of your shares of common stock, please follow each of the separate proxy voting instructions that you received for your shares of common stock held in each of your different accounts. We expect to send the Notice to most of our stockholders by mail or email beginning on or about March 13, 2020.

The Notice includes, among other matters: (i) the place, date and time of the annual meeting; (ii) a brief description of the proposals to be voted on at the annual meeting and the Board’s voting recommendation with regard to each proposal; (iii)

information regarding the website where the proxy materials are soliciting proxies primarilyposted; (iv) various methods by mail. In addition, our directors, officerswhich a stockholder may request paper or electronic copies of the proxy materials; and other employees may solicit proxies(v) instructions on how to vote by Internet, by telephone, by mail or facsimilein person at the annual meeting.

What is “householding”?

SEC rules permit us to deliver a single copy of this proxy statement and our 2019 Annual Report to any household not participating in electronic proxy material delivery at which two or

personally. These individualsmore stockholders reside, if we believe the stockholders are members of the same family. This practice, known as “householding,” is designed to reduce our printing and postage costs. If your household received a single set of proxy materials, but you would prefer to receive a separate copy of this proxy statement or our 2019 Annual Report, you may contact Broadridge Householding Department, by calling their toll free number, 1-866-540-7095, or by writing to: Broadridge Householding Department, 51 Mercedes Way, Edgewood, NY 11717, and they will

receive no additional compensation for their services beyond their regular compensation.deliver those documents to you promptly upon receiving your request.

You may request or discontinue householding in the future by contacting the broker, bank or similar institution through which you hold your shares. You may also change your householding preferences through Broadridge using the contact information provided above. You will be removed from the householding program within 30 days of receipt of your instructions.

SECURITY OWNERSHIP OF DIRECTORS, OFFICERS AND CERTAIN BENEFICIAL OWNERS

Our executive officers and directors are encouraged to own Greenhill common stock, par value $0.01 per share, to further align management’s and stockholders’ interests. In addition, we have adopted stock ownership guidelines applicable to our named executive

officers.officers (“NEOs”). See

“Executive“Executive Compensation—Compensation Discussion and Analysis—Other Compensation Program and Governance Features”Features” below for a description of these guidelines.

The following table shows how many shares of our common stock were beneficially owned as of

May 31, 2017,March 3, 2020, by each of our directors and executive officers named in the

20162019 Summary Compensation Table in this proxy statement, and by all of our directors and executive officers as a group. To the best of our knowledge, based on filings made under Section 13(d) and Section 13(g) of the Securities Exchange Act of 1934, as amended (“

Exchange Act”) (“Filings”), except as noted below, no stockholder beneficially owned more than five percent of our common stock as of

May 31, 2017.March 3, 2020. The percentage has been calculated on the basis of

29,605,10618,771,782 shares of common stock outstanding as of

May 31, 2017March 3, 2020 (excluding treasury stock).

The address for each listed stockholder (other than as indicated in the notes) is: c/o Greenhill & Co., Inc., 300 Park Avenue,

23rd Floor, New York, New York 10022. To our knowledge, except as indicated in the footnotes to this table, pursuant to applicable community property laws or as indicated in the Filings made by institutional stockholders, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by them.

| | | | | | | | |

| | | Shares Beneficially Owned | |

| Name of Beneficial Owner | | Number | | | Percent | |

Directors and Named Executive Officers: | | | | | | | | |

Robert F. Greenhill (1) | | | 1,506,749 | | | | 5.1% | |

Scott L. Bok (2) | | | 772,486 | | | | 2.6% | |

Kevin M. Costantino | | | 15,039 | | | | * | |

David A. Wyles | | | — | | | | * | |

Harold J. Rodriguez, Jr. (3) | | | 93,998 | | | | * | |

Christopher T. Grubb | | | — | | | | * | |

Patricia Moran | | | 9,510 | | | | * | |

Robert T. Blakely | | | 7,489 | | | | * | |

Steven F. Goldstone | | | 27,496 | | | | * | |

Stephen L. Key | | | 17,510 | | | | * | |

John D. Liu | | | 6,209 | | | | * | |

Karen P. Robards | | | 10,398 | | | | * | |

All Directors and Executive Officers as a group (12 persons) | | | 2,466,884 | | | | 8.3% | |

5% Stockholders: | | | | | | | | |

BlackRock, Inc. (4) | | | 3,442,908 | | | | 11.6% | |

The Vanguard Group (5) | | | 2,294,757 | | | | 7.8% | |

* | Less than 1% of the outstanding shares of common stock. |

(1) | Mr. Greenhill’s beneficial ownership is calculated by attributing to him all shares of our common stock owned by him and by two entities controlled by him. The first entity is Greenhill Family Limited Partnership, a Delaware limited partnership, which owns 989,524 of our shares. The second entity is Riversville Aircraft Corporation II, a Delaware corporation, which owns 239,680 of our shares. Mr. Greenhill expressly disclaims beneficial ownership of the shares of common stock held by other members of his family in Greenhill Family Limited Partnership. |

(2) | Includes 320,552 shares held by a grantor retained annuity trust for the benefit of Mr. Bok and his two children. Also includes 25,000 shares held by Bok Family Partners L.P., a Delaware limited partnership, of which Mr. Bok is the general partner. Mr. Bok disclaims beneficial ownership of securities owned by Bok Family Partners L.P. except to the extent of his pecuniary interest therein. Also includes 288,783 shares held by the Bok Family Foundation. Mr. Bok expressly disclaims beneficial ownership of the shares held by the Bok Family Foundation. |

(3) | Includes 93,998 shares held by Jacquelyn F. Rodriguez, the wife of Harold J. Rodriguez, Jr. |

(4) | Address: 55 East 52nd Street, New York, NY 10022. |

(5) | Address: 100 Vanguard Blvd., Malvern, PA 19355. |

| | | | | | | | | | | | | | |

| | | Shares Beneficially Owned | | |

Name of Beneficial Owner | | Number | | Percent |

| | | | |

| | | | |

| Directors and Named Executive Officers: | | | | |

| Robert F. Greenhill (1) | | 2,453,896 | | | 13.1 | % |

| Scott L. Bok (2) | | 1,956,927 | | | 10.4 | % |

| Kevin M. Costantino | | 40,027 | | | * |

| David A. Wyles | | 51,234 | | | * |

| Harold J. Rodriguez, Jr. (3) | | 148,040 | | | * |

| Gitanjali P. Faleiro | | — | | | * |

| Steven F. Goldstone | | 45,533 | | | * |

| Meryl D. Hartzband | | 10,275 | | | * |

| Stephen L. Key | | 27,611 | | | * |

| John D. Liu | | 14,456 | | | * |

| Karen P. Robards | | 19,309 | | | * |

| All Directors and Executive Officers as a group (10 persons) | | 4,767,308 | | | 25.4 | % |

| Other 5% Stockholders: | | | | |

| BlackRock, Inc. (4) | | 2,456,975 | | | 13.1 | % |

| Capital World Investors (5) | | 1,169,700 | | | 6.2 | % |

| The Capital Management Corporation (6) | | 1,118,224 | | | 6.0 | % |

| The Vanguard Group (7) | | 1,049,369 | | | 5.6 | % |

* Less than 1% of the outstanding shares of common stock.

(1) Mr. Greenhill’s beneficial ownership is calculated by attributing to him all 425,212 shares of our common stock owned by him and by three entities controlled by him: (i) Greenhill Family Limited Partnership, a Delaware limited partnership, which owns 989,524 of our shares, (ii) Riversville Aircraft Corporation II, a Delaware corporation, which owns 239,680 of our shares and (iii) Socatean Partners, a Connecticut general partnership, which owns 799,480 of our shares. Mr. Greenhill expressly disclaims beneficial ownership of the shares of common stock held by other members of his family in Greenhill Family Limited Partnership.

(2) Mr. Bok’s beneficial ownership is calculated by attributing to him all 268,806 shares of our common stock owned by him and by four entities: (i) Bok Family Partners, L.P., which owns 867,463 of our shares, (ii) Bok Family Foundation, which owns 288,783 of our shares, (iii) Scott L. Bok November 2018 Annuity Trust, which owns 267,958 of our shares and (iv) Scott L. Bok May 2019 Annuity Trust, which owns 263,917 of our shares. Mr. Bok expressly disclaims beneficial ownership of securities owned by Bok Family Partners, L.P. and of the shares held by the Bok Family Foundation.

(3) Includes 52,285 shares held by Jacquelyn F. Rodriguez, the wife of Harold J. Rodriguez, Jr.

(4) The address and business telephone number for BlackRock, Inc. are 55 East 52nd Street, New York, NY 10055 and (212) 810-5300, respectively. This information is based on the most recent Schedule 13G/A filed by BlackRock, Inc. on February 4, 2020.

(5) The address and business telephone number for Capital World Investors are 333 South Hope Street, 55th Floor, Los Angeles, CA 90071 and (213) 486-9200, respectively. This information is based on the most recent Schedule 13G/A filed by Capital World Investors on February 14, 2020.

(6) The address and business telephone number for The Capital Management Corporation are 4104 Cox Road, Suite 110, Glen Allen, VA 23060 and (804) 270-4000, respectively. This information is based on the most recent Schedule 13G filed by The Capital Management Corporation on January 17, 2020.

(7) The address and business telephone number for The Vanguard Group are PO Box 2600, V26, Valley Forge, PA 19482 and (610) 669-1000, respectively. This information is based on the most recent Schedule 13G/A filed by The Vanguard Group on February 12, 2020.

Our executive officers and directors are not permitted to hedge or otherwise dispose of the economic risk of ownership of these shares or any other shares owned by them through short sales, option transactions or use of derivative instruments. See

“Executive“Executive Compensation—Compensation Discussion and Analysis—Other Compensation Program and Governance Features”Features” below.

Messrs. Greenhill, Bok, Costantino,

Grubb, Rodriguez and Wyles,

and Ms. Faleiro are employees of Greenhill.

Ms. Moran ceased to be an employee of Greenhill on April 30, 2017. As of

May 31, 2017, Messrs. Greenhill, Bok, Costantino, Grubb, Rodriguez and WylesMarch 3, 2020, they beneficially own approximately

8%25% of our outstanding common stock in the aggregate. In addition, as of

May 31, 2017,March 3, 2020, other employees of Greenhill beneficially own approximately

4%30% of our outstanding common stock in the aggregate.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, directors and beneficial owners of more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership of our securities with the Securities and Exchange Commission (the “SEC”). Such persons are required to furnish us with copies of these reports. We believe that all Section 16(a) filing requirements applicable to our executive officers and directors for 2016 were satisfied.

ITEM 1—ELECTION OF DIRECTORS

The number of directors currently serving on our Board of Directors (which we also refer to as our “Board”) is seven. One of our current

independent directors,

Robert T. Blakely,Stephen L. Key, has elected to retire

from the Board after many years of service and will therefore not stand for reelection. His retirement will be effective

July 26, 2017 and is not standing for re-election.April 23, 2020. Following the retirement of Mr. Key, the number of directors that will serve on our Board will be six; a majority of our Board will continue to consist of independent directors. Accordingly, there are six nominees for director this year, and each nominee is a current director. Each director who is elected will serve a one-year

term.term which expires at our 2021 annual meeting. Each of the nominees has agreed to serve as a director if elected. If, for any reason, any nominee becomes unable to serve before the election, the persons named as proxies may vote your shares for a substitute nominee selected by the Board or the Board may reduce its size.

All of our directors must be elected by a majority vote of our stockholders.

The nominees for election as director have provided the following information about themselves.

Robert F. Greenhill, 80, our founder,

Scott L. Bok, 60, has served as our Chairman since the time of our founding in 1996 and served as our Chief Executive Officer between 1996 and October 2007. In addition, Mr. Greenhill has been a director of Greenhill & Co., Inc. since its incorporation in March 2004. Prior to founding and becoming Chairman of Greenhill, Mr. Greenhill was Chairman and Chief Executive Officer of Smith Barney Inc. and a member of the Board of Directors of the predecessor to the present Travelers Corporation (the parent of Smith Barney) from June 1993 to January 1996. From January 1991 to June 1993, Mr. Greenhill was president of, and from January 1989 to January 1991, Mr. Greenhill was a vice chairman of, Morgan Stanley Group, Inc. Mr. Greenhill joined Morgan Stanley in 1962 and became a partner in 1970. In 1972, Mr. Greenhill directed Morgan Stanley’s newly-formed mergers and acquisitions department. In 1980, Mr. Greenhill was named director of Morgan Stanley’s investment banking division, with responsibility for domestic and international corporate finance, mergers and acquisitions, merchant banking, capital markets services and real estate. Also in 1980, Mr. Greenhill became a member of Morgan Stanley’s management committee. We chose to nominate Mr. Greenhill as a director because he is the founder of our firm and has more than fifty years of experience in our industry.Scott L. Bok, 58,2019, has served as Chief Executive OfficerCEO since April 2010, served as Co-Chief Executive OfficerCo-CEO between October 2007 and April 2010, and has served as our U.S. President between January 2004 and October 2007. He has also served as a member of our Management Committee since its formation in January 2004. In addition, Mr. Bok has been a director of Greenhill & Co., Inc. since its incorporation in March 2004. Mr. Bok joined Greenhill as a Managing Director in February 1997. Before joining Greenhill, Mr. Bok was a Managing Director in the mergers, acquisitions and restructuring department of Morgan Stanley & Co., where he worked from 1986 to 1997, based in New York and London. From 1984 to 1986, Mr. Bok practiced mergers and acquisitions and securities law in New York with Wachtell, Lipton, Rosen & Katz. Mr. Bok also served as a member of the Board of Directors of Iridium Communications Inc., from 2009 to 2013. We chose to nominate Mr. Bok as a director because he serveshas significant and relevant experience in managing and leading our firm successfully; in addition, he is a trusted advisor to many of the firm’s clients as our Chief Executive Officer and hasa result of more than thirty years of experience advising on complex transactions.

Robert F. Greenhill, 83, our Founder and Chairman Emeritus, served as our Chairman from 1996 to April 2019, and as our Chief Executive Officer (“CEO”) from 1996 to 2007. In addition, Mr. Greenhill has been a director of Greenhill & Co., Inc. since its incorporation in March 2004. Prior to founding and becoming Chairman of Greenhill, Mr. Greenhill was Chairman and CEO of Smith Barney Inc. and a member of the Board of Directors of the predecessor to the present Travelers Corporation (the parent of Smith Barney) from June 1993 to January 1996. From January 1991 to June 1993, Mr. Greenhill was president of, and from January 1989 to January 1991, a vice chairman of, Morgan Stanley Group, Inc. Mr. Greenhill joined Morgan Stanley in 1962 and became a partner in 1970. In 1972, Mr. Greenhill directed Morgan Stanley’s newly-formed mergers and acquisitions department. In 1980, Mr. Greenhill was named director of Morgan Stanley’s investment banking division, with responsibility for domestic and international corporate finance, mergers and acquisitions, merchant banking, capital markets services and real estate. Also in 1980, Mr. Greenhill became a member of Morgan Stanley’s management committee. We chose to nominate Mr. Greenhill as a director because he is the founder of our firm and has more than fifty years of experience in our industry.

Steven F. Goldstone,71, 74, has served on our Board of Directors since July 2004 and has also served as our Lead Independent Director since January 2016. He currently manages Silver Spring Group, a private investment firm. From 1995 until his retirement in 2000, Mr. Goldstone was Chairman and Chief Executive OfficerCEO of RJR Nabisco, Inc. (which was subsequently named Nabisco Group Holdings following the reorganization of RJR Nabisco, Inc.). Prior to joining RJR Nabisco, Inc., Mr. Goldstone was a partner at Davis Polk & Wardwell, a law firm in New York City. He is alsojoined the Board of Directors of ConAgra Foods, Inc., in 2003 and was appointed the non-executive Chairman of ConAgra Foods, Inc.in 2005, retaining that position until his retirement in October 2018. Mr. Goldstone served as a member of the Board of Directors of Trane, Inc. (f/k/a American Standard Companies, Inc.) from 2002 until 2008 and as a member of the Board of Directors of Merck & Co. from 2008 until 2012. Mr. Goldstone has also served as a member of the Board of Directors of The Chefs’ Warehouse, Inc. since March 2016. We chose to nominate Mr. Goldstone as a director because he was personally known to several members of our management, who respected Mr. Goldstone’sis a recognized leader with high integrity and business acumen. We believe Mr. Goldstone’s past experience in a service industry similar to ours, as well as his experience as the leader of a complex publicly traded company, enables Mr. Goldstone to provide valuable experience to our Board.Stephen L. Key, 73,

Meryl D. Hartzband, 65, has served on our Board of Directors since May 2004. Since 2003, Mr. Key has been the sole proprietor of Key Consulting, LLC. From 1995 to 2001, Mr. Key was the Executive Vice President and Chief Financial Officer of Textron Inc., and from 1992 to 1995, Mr. Key was the Executive Vice President and Chief Financial Officer of ConAgra, Inc. From 1968 to 1992, Mr. Key worked at Ernst & Young, serving in various capacities, including as the Managing Partner of Ernst & Young’s New York Office from 1988 to 1992. Mr. Key is a Certified Public Accountant in the State of New York. Mr. Key served as a member ofJuly 2018. Ms. Hartzband currently serves on the Board of Directors of FairwayEverest Re Group, Holdings Corp. from 2012 to 2016Ltd., a publicly-traded insurance and as Chairman of the Audit Committee ofreinsurance company listed on NYSE, and the Board of Directors of FairwayConning Holdings Limited, a leading global investment management firm. Past directorships include The Navigators Group, Inc., ACE Limited, Travelers Property Casualty Corp., AXIS Capital Holdings Corp. from 2013Limited, Alterra Capital Holdings Limited, and numerous portfolio companies of the Trident Funds. She was a founding partner of Stone Point Capital, a private equity firm that focuses on investing in the global financial services industry. From 1999 to 2016. Mr. Key has also2015, she served as a member of the Board of Directors of Sitel, Inc. from 2007 until 2008, as a member of the Board of Directors of Forward Industries, Inc. from 2010 until 2012,firm’s Chief Investment Officer and as a member of the BoardInvestment Committees of Directors of 1-800-Contacts, Inc. from 2005the Trident Funds. Prior to 2012.that, she was a Managing Director at J.P. Morgan Chase & Co., where, during a 16-year career, she specialized in managing private equity investments in the financial services industry. We chose to nominate Mr. Keybelieve Ms. Hartzband’s specialty knowledge around strategies for investment portfolios in the insurance industry and her financial background, as well as her experiences as a director because he was personally known to several members of our management, who respected Mr. Key’s high integrity and financial expertise. We believe Mr. Key’s deep accounting experience, his service on the board of directors and audit committees of other public companies and his previousmanagement experience at several public and private companies, add significant support bothprovide valuable perspectives to the Board of Directors and the management team in considering accounting, finance and related matters.

our Board.

John D. Liu, 49, 51, has served on our Board of Directors since June 2017. Since March 2008, Mr. Liu has been the chief executive officerCEO of Essex Equity Management, a financial services company, and managing partner of Richmond Hill Investments, an investment management firm. Prior to that time, Mr. Liu was employed for 12 years by Greenhill until March 2008 in positions of increasing responsibility, including as chief financial officer from January 2004 to March 2008 and as co-head of U.S. Mergers and Acquisitions from January 2007 to March 2008. Earlier in his career, Mr. Liu worked at Wolfensohn & Co. and was an analyst at Donaldson, Lufkin & Jenrette. Mr. Liu also serves as a member of the Board of Directors of Whirlpool Corporation. We chose to nominate Mr. Liu as a director because he was personally known to several members of management and the board of directors, who respected Mr. Liu’sis a recognized leader with high integrity and financial expertise. We believe Mr. Liu’s significant finance and accounting experience, his service on the board of directors and audit committee of another public companyWhirlpool Corporation and his previous management experience at Greenhill and other financial services companies will bring valuable perspectives to the oversight of our business.

Karen P. Robards, 67,70, has served on our Board of Directors since April 2013. Since 1987, Ms. Robards has been a principal of Robards & Company, LLC, a consulting and private investment firm. From 1976 to 1987, Ms. Robards was an investment banker at Morgan Stanley where she served as head of its healthcare investment banking activities. Ms. Robards currently serves as Vice ChairCo-Chair of the Fixed Income Board at BlackRock and Chaira member of the Audit Committee of the BlackRock Closed-EndFixed Income Funds. Ms. Robards served as a member of the Board of Directors of AtriCure, Inc., a medical device company, from 2000 to May 2017. From 1996 to 2005, Ms. Robards served as a director of Enable Medical Corporation, a developer and manufacturer of surgical instruments, which was acquired by AtriCure, Inc. in 2005. From 2007 to 2010, Ms. Robards also served as a director of Care Investment Trust, a publicly held real estate investment trust focusing on investment opportunities in the healthcare industry. We chose to nominate Ms. Robards as a director because of her high integrity and business acumen. We believe Ms. Robards’ past experience in our industry, as well as her experience as a director of several public and private companies, enables Ms. Robards to provide valuable experience to our Board. The Board

of Directors unanimously recommends a vote FOR the election of all of the director nominees. Proxies will be voted FOR the election of the nominees unless otherwise specified.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The Board

of Directors conducts its business through meetings of the Board and the following standing committees: Audit, Compensation, and Nominating and Governance. Each of the

three standing committees has adopted and operates under a written charter. Our Corporate Governance Guidelines also provide for a Lead Independent Director. All of our corporate governance documents, including our written committee charters, our Corporate Governance Guidelines, our Code of Business Conduct and Ethics and our Related Person Transaction Policy, are available on our website at www.greenhill.com. The written charters, the Guidelines, the Code and the Related Person Transaction Policy are also available in print to any stockholder who requests them.

Director Independence

Under applicable NYSE listing standards, a majority of the Board of Directors must be independent, and no director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with Greenhill. In connection with this independence determination, the Board considered transactions and relationships between each director or director nominee or any member of his or her immediate family and Greenhill and its subsidiaries and affiliates, including those reported under “Certain Relationships and Related Transactions” below. The Board also examined transactions and relationships between directors and our director nominee or their affiliates and members of Greenhill’s senior management or their affiliates. The purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director or director nominee is independent.

The Board determined that, in 2019, none of Messrs. Goldstone, Key or Liu or Mses. Hartzband or Robards:

•had any material relationship with Greenhill (other than as directors)

•had any material relationship, either directly or as a partner, stockholder or officer, of another organization that has a relationship with Greenhill

•is an employee or has an immediate family member who is or has in the last three years been an executive officer of Greenhill

•receives, or has an immediate family member who receives, more than $120,000 in direct compensation from Greenhill (other than director and committee fees)

•is affiliated with or employed by, or has an immediate family member who is or has been within the past three years a partner of or employee of, the Greenhill audit team or a present or former internal or external auditor of Greenhill

•is employed or has an immediate family member who is employed as an executive officer of another company where any of Greenhill’s present executives serve on the compensation committee

•is an executive officer of a company that makes payment to or receives payments from Greenhill for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues

•is an executive officer of any charitable organization to which Greenhill has contributed an amount in any single fiscal year in excess of $1 million or 2% of the consolidated gross revenues of such charitable organization.

As a result of this review, the Board affirmatively determined that each of our non-employee directors (Steven F. Goldstone, Meryl D. Hartzband, Stephen L. Key, John D. Liu and Karen P. Robards) is “independent” as that term is defined in the applicable NYSE listing standards. Messrs. Greenhill and Bok cannot be considered independent directors because of their employment at Greenhill.

In addition, pursuant to our Corporate Governance Guidelines, Steven F. Goldstone has served as our Lead Independent Director since January 2016.

Meetings of the Independent Directors

In addition to the committees of the Board

of Directors described below, our non-employee directors meet regularly in executive sessions in which our employee directors (Messrs. Greenhill and Bok) and other members of management do not participate. The Lead Independent Director

(Mr. Goldstone) serves as the presiding director of these executive sessions.

Stephen L. Key

(Chair)(Chair, until April 23, 2020)

Meryl D. Hartzband (Chair, commencing April 23, 2020)

The Audit Committee is a separate committee established in accordance with Rule 10A-3 under the

Securities Exchange Act,

comprised entirely of

1934.independent, non-employee directors. The Board

of Directors has determined that all members of the Audit Committee are “independent” as that term is defined in the applicable

New York Stock ExchangeNYSE listing standards and regulations of the Securities and Exchange Commission

(“SEC”) and that all members are financially literate as required by the applicable

New York Stock ExchangeNYSE listing standards.

TheFollowing the retirement of Mr. Key from the Board

and chairmanship of

Directors also hasthe Audit Committee, the Board determined that

Mr. KeyMs. Hartzband is an “audit committee financial expert” as defined by applicable regulations of the

Securities and Exchange Commission.SEC. Ms. Hartzband will serve as chair of the Audit Committee following the annual meeting.

The Audit Committee’s purpose is to oversee the independent auditor’s qualifications, independence and performance, the integrity of our financial statements, the performance of our internal audit function and independent auditors and compliance with legal and regulatory requirements. The Audit Committee has sole authority to retain and terminate the independent auditors and is directly responsible for the compensation and oversight of the work of the independent auditors. The Audit Committee reviews and discusses with management and the independent auditors the annual audited and quarterly financial statements, reviews the integrity of the financial reporting processes, both internal and external, and prepares the Audit Committee Report included in the proxy statement in accordance with the rules and regulations of the

Securities and Exchange Commission.SEC. The Audit Committee met five times during

2016.2019. In addition, the SEC Subcommittee of the Audit Committee, which is responsible for reviewing periodic reports of Greenhill filed with the SEC

met three times during 2016. Mr. Key isto the

sole member ofextent not previously reviewed by the

SEC Subcommittee, although other Audit Committee,

members participate in SEC Subcommittee meetings from time to time.met twice during 2019.

Steven F. Goldstone (Chair)

Stephen L. Key

(until April 23, 2020)

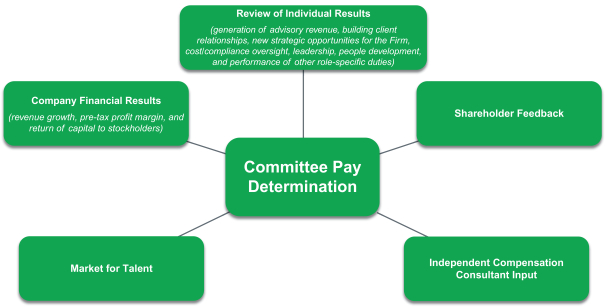

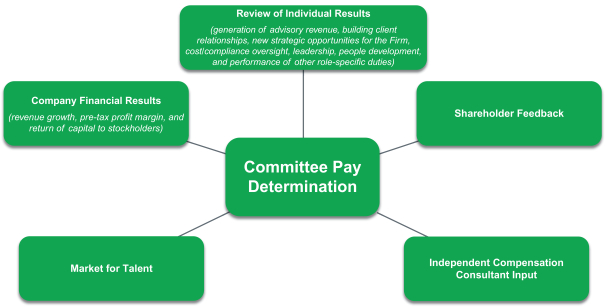

The Compensation Committee, comprised entirely of independent, non-employee directors, is responsible for establishing and administering our policies involving the compensation of our executive officers.

No employee of Greenhill serves on the Compensation Committee. The Compensation Committee members have no interlocking relationships as defined by the Securities and Exchange Commission.The Board of Directors has determined that all members of the Compensation Committee are “independent” as that term is defined in applicable New York Stock ExchangeNYSE listing standards. The Compensation Committee oversees our compensation and benefits policies generally, evaluates senior executive performance, oversees and sets compensation for our senior executives and reviews management’s succession plan. The Compensation Committee evaluates our compensation philosophy, goals and objectives generally, and it approves corporate goals related to the compensation of our senior executives (including the Chief Executive Officer)CEO), and approves compensation and compensatory arrangements applicable to our other executive officers based on our compensation goals and objectives. See “Executive“Executive Compensation—Compensation Discussion and Analysis”Analysis” for more information on the Compensation Committee’s role in determining compensation. In addition, the Compensation Committee is responsible for reviewing and recommending the establishment of broad-based incentive compensation, equity-based, retirement or other material employee benefit plans, and for discharging any duties under the terms of our equity incentive plan. The Compensation Committee recommended that the Board approve an equity incentive plan in 2015, and this recommendation was made again in 2019 in respect of the 2019 equity incentive plan (each an “Equity Incentive Plan”, and together, the “Equity Incentive Plans”). The Compensation Committee met three times during 2016.

2019.

Compensation Committee Interlocks and Insider Participation

No employee of Greenhill serves on the Compensation Committee and the Compensation Committee members have no interlocking relationships (defined under SEC rules). John D. Liu served on the Compensation Committee during 2019 and previously served as Greenhill’s chief financial officer from January 2004 to March 2008 and as co-head of U.S. Mergers and Acquisitions from January 2007 to March 2008.

Nominating and Governance Committee

Stephen L. Key

(until April 23, 2020)

The Board

of Directors has determined that all members of the Nominating and Governance Committee are “independent” as that term is defined in applicable

New York Stock ExchangeNYSE listing standards. The Nominating and Governance Committee identifies and recommends individuals qualified to become members of the Board

of Directors and recommends to the Board sound corporate governance principles and practices for Greenhill. In particular, the Committee assesses the independence of all Board members, identifies and evaluates candidates for nomination as directors, recommends the slate of director nominees for election at the annual meeting of stockholders and to fill vacancies between annual meetings, recommends qualified members of the Board for membership on committees, oversees the director orientation and continuing education programs, reviews the

Board��sBoard’s committee structure, reviews and assesses the adequacy of our Corporate Governance Guidelines, evaluates the annual evaluation process for the Board and Board committees and is charged with overseeing our Related Person Transaction Policy. The Nominating and Governance Committee met

twothree times during

2016.2019.

Our Corporate Governance Guidelines provide that our directors are expected to attend meetings of the Board and of the committees on which they serve. We do not have a policy requiring directors to attend our annual meeting of stockholders. The Board met

seveneight times during

2016. Five2019. All of our directors attended the annual meeting of stockholders in

2016,2019, and all of our directors attended at least 75% of the Board and committee meetings on which the directors served.

All directors standing for reelection plan to attend the 2020 annual meeting.

Procedures for Contacting the Board of Directors

The Board has established a process for stockholders and other interested parties to send written communications

Communications to the Board, the independent directors, or to individual

directors. Such communications may be made anonymously. Such communications shoulddirectors can be sent by U.S. mail

to theto: Board of Directors, c/o Greenhill, 300 Park Avenue, New York, New York, 10022 (attention:

General Counsel and Company Secretary).

The communications will be collected by the Secretary and delivered, in the form received and if so addressed, to a specified director, the independent directors, the Lead Independent Director or the Audit Committee or its Chairman. Items that are unrelated to a director’s duties and responsibilities as a Board member may be excluded by the Secretary, including solicitations and advertisements, junk mail and resumes.

Procedures for Selecting and Nominating Director Candidates

In evaluating the appropriate characteristics of candidates for service as a director, the Nominating and Governance Committee takes into account many factors. At a minimum, director candidates must demonstrate high standards of ethics, integrity and professionalism, independence, sound judgment, community leadership and meaningful experience in business, law or finance or other appropriate endeavor. In addition, the candidates must be committed to representing the long-term interests of our stockholders. In addition to these minimum qualifications, the Committee also considers other factors it deems appropriate based on the current needs of the Board, including specific business and financial expertise currently

desired on the Board, experience as a director of a public company and diversity. The Committee does not have any formalself-identified diversity policy.characteristics. With these factors and characteristics in mind, the Committee will generally begin its search by discussing potential candidates with existing members of the Board and management. The Committee will also reassess the qualifications of a director, including the director’s past contributions to the Board and the director’s attendance and contributions at Board and committee meetings, prior to recommending a director for reelection to another term.

Our Board

of Directors has adopted procedures by which stockholders may recommend nominees to the Board.

On March 4, 2020, the Board amended the Company’s Amended and Restated Bylaws (the “Bylaws”) to implement proxy access. The Bylaws, as amended and restated, include a section that sets forth the circumstances under which stockholders may include nominees for director in our annual meeting proxy materials. See “Proposal No. 3—Stockholder Proposal.” The Nominating and Governance Committee will consider any director candidate recommended by stockholders in accordance with the procedures set out in our bylaws and applicable law on the same basis as it considers other director candidates. Stockholders may also submit a letter and relevant information about the candidate to the

Corporate Secretary at Greenhill & Co., Inc., 300 Park Avenue, New York, New York 10022.

Board Leadership Structure and Role in Risk Oversight

The Chairman of our Board of Directors, Robert F. Greenhill, is the founder of Greenhill and has previously served as its Chief Executive Officer. In 2007, Mr. Greenhill relinquished the position as Chief Executive Officer. At that time, the Board of Directors determined that it was in the best interests of our stockholders for Mr. Greenhill to continue to serve as Chairman of the Board, given the depth of his experience with our firm and our industry. In January 2016, our Board of Directors amended our

Our Corporate Governance Guidelines

to provide for a “Lead Independent Director”

and appointed. Steven F. Goldstone

tois currently serving in this role. The Lead Independent Director’s responsibilities include:

| (1) | Chair any meeting of the Board at which the Chairman is not present, including executive sessions of non-management or independent directors; |

| (2) | Have the authority to call meetings of the non-management or independent directors; |

| (3) | Meet with any director who is not adequately performing his or her duties as a member of the Board or any committee; |

| (4) | Facilitate communications between other members of the Board and the Chairman of the Board and/or the Chief Executive Officer by serving as the principal liaison; however, each director is free to communicate directly with the Chairman of the Board and with the Chief Executive Officer; |

| (5) | Monitor, with the assistance of the Company’s Chief Executive Officer, Chief Financial Officer and General Counsel, communications from stockholders and other interested parties, report on such communications to the other directors as he or she considers appropriate, and be available, when appropriate, for consultation and direct communication with stockholders; |

| (6) | Work with the Chairman of the Board and the CEO in the preparation of the agenda for each Board meeting and approve the agendas to be sent to the Board; and be available to review information to be sent to the Board when appropriate; |

| (7) | Work with the Chairman of the Board in determining the need for special meetings of the Board, and approve the number and frequency of Board meetings and meeting schedules, assuring there is sufficient time for discussion of all agenda items; and |

| (8) | Otherwise consult with the Chairman of the Board and/or the Chief Executive Officer on matters relating to corporate governance and Board performance. |

(1) Chair any meeting of the Board at which the Chairman is not present, including executive sessions of non-management or independent directors;

(2) Have the authority to call meetings of independent directors;

(3) Meet with any director who is not adequately performing his or her duties as a member of the Board or any committee;

(4) Facilitate communications between other members of the Board and the Chairman of the Board and CEO by serving as the principal liaison; however, each director is free to communicate directly with the Chairman of the Board and CEO;

(5) Monitor, with the assistance of the Company’s Chairman and CEO, Chief Financial Officer and General Counsel, communications from stockholders and other interested parties, report on such communications to the other directors as he or she considers appropriate, and be available, when appropriate, for consultation and direct communication with stockholders;

(6) Work with the Chairman of the Board and the CEO in the preparation of the agenda for each Board meeting and approve the agendas to be sent to the Board; and be available to review information to be sent to the Board when appropriate;

(7) Work with the Chairman of the Board in determining the need for special meetings of the Board, and approve the number and frequency of Board meetings and meeting schedules, assuring there is sufficient time for discussion of all agenda items; and

(8) Otherwise consult with the Chairman of the Board / the CEO on matters relating to corporate governance and Board performance.

Our Board, of Directors, under the guidance of the Nominating and Governance Committee, reviews the structure of our Board of Directors and its committees each year as a part of its annual self-evaluation process, and in that context considers, among other things, issues of structure and leadership, including whether the offices of Chairman of the Board and Chief Executive OfficerCEO should be combined or separate, and whether the Board’s leadership structure is appropriate given the characteristics or circumstances of the Company. The Board believes that having Mr. Bok serve as both CEO and Chairman of Directorsthe Board is the most appropriate leadership structure for the Company at this time. Mr. Bok is the director most familiar with the Company’s business operations and the industry in which it operates, and best positioned to set and execute the Company’s business strategies. In addition, we believe the combined role of Chairman and CEO provides enhanced efficiency, effective decision making and clear accountability.

The Board is satisfied that its current structure and processes are well suited for the Company, given its simple business model, employee stock ownership and size.

Management is principally responsible for managing risks within the businesses on a day-to-day basis. The Board

of Directors has delegated

oversight of risk management

and oversight to the Audit Committee. The Audit Committee receives

from management regular reports on risk matters, including financial, legal and regulatory risks, at its quarterly meetings. The Audit Committee also receives an annual report on legal, regulatory and compliance matters from the Greenhill Global Compliance

Committee. The Audit Committee oversees the Company’s periodic risk assessments and risk-based internal audits. In addition, the Audit Committee meets regularly with the Chief Compliance Officer, principal accounting officerChief Financial Officer and General Counsel of Greenhill as well as its external and internal auditors, to discuss issues related to risk management. The Audit Committee, in turn, reports any material risk issues which may arise to the full Board of Directors. The Board of Directors’ administration of risk oversight has no impact on its leadership structure.

Board.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics applicable to all of our directors and employees, including our principal executive officers, principal financial officer, principal accounting officer, controller and other employees performing similar functions. A copy of this Code of Business Conduct and Ethics is available on our website at www.greenhill.com.

We intend to post on our website any amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics that applies to our principal executive officers, principal financial officer, principal accounting officer, controller and other persons performing similar functions within four business days following the date of such amendment or waiver.

DIRECTOR COMPENSATION TABLE

2016

2019 Non-Employee Director Compensation | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash | | | Stock Awards (1) | | | Total | |

Robert T. Blakely (2) | | $ | 50,012 | | | $ | 49,988 | | | $ | 100,000 | |

Steven F. Goldstone | | | — | | | | 100,000 | | | | 100,000 | |

Stephen L. Key | | | 57,497 | | | | 57,503 | | | | 115,000 | |

Karen P. Robards | | | — | | | | 100,000 | | | | 100,000 | |

(1) | These amounts reflect the aggregate grant date fair value determined in accordance with FASB ASC Topic 718 for awards granted in 2016 pursuant to our Equity Incentive Plan. As these awards are fully vested, the entire expense arising from them is recognized in the year the services were rendered to which they relate. |

(2) | Mr. Blakely has elected to retire from the Board effective July 26, 2017 and is not standing for re-election. |

(1) | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | Stock Awards (1) | | Total |

| Steven F. Goldstone | | $ | — | | | $ | 125,005 | | | $ | 125,005 | |

| Meryl D. Hartzband | | — | | | 125,005 | | | 125,005 | |

| Stephen L. Key (2) | | 69,990 | | | 70,010 | | | 140,000 | |

| John D. Liu | | 62,513 | | | 62,487 | | | 125,000 | |

| Karen P. Robards | | 70,321 | | | 54,679 | | | 125,000 | |

(1) These amounts reflect the aggregate grant date fair value determined in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 for awards related to 2019 pursuant to our Equity Incentive Plan. As these awards are fully vested, the entire expense arising from them is recognized in the year the services were rendered to which they relate.

(2) The amounts for Stephen L. Key include the additional annual retainer of $15,000 that he received for service as Chairman of the Audit Committee as more fully described below. Mr. Key has elected to retire from the Board, effective April 23, 2020, and is not standing for re-election.

During

2016,2019, directors who were not Greenhill employees received an annual retainer of

$100,000$125,000 for service on our Board

of Directors payable at their

optionelection either in cash or

fully vested stock or a

combination.combination thereof. No separate meeting fees were paid. The chairman of the Audit Committee received an additional annual retainer of $15,000, which was paid at his

optionelection in a combination of cash and stock. We have not retained any compensation consultants to advise on director compensation.

In 2017, our Board of Directors approved an increase in director compensation. Beginning in 2017, directors who are not Greenhill employees will receive an annual retainer of $125,000 for service on our Board of Directors, and the chairman of the Audit Committee will continue to receive an additional annual retainer of $15,000.

It is our policy to ask our non-employee directors to retain any stock granted to them as compensation until such time as they complete their service on the Board, subject to exceptions for unforeseen personal circumstances. As of December 31,

2016,2019, all of our non-employee directors owned stock in the Company.

As a result, we believe our non-employee directors have a demonstrable and significant interest in increasing the stockholders’ value over the long term, and we have not adopted any stock ownership guidelines for non-employee directors.Our non-employee directors are also prohibited from hedging or otherwise disposing of the economic risk of ownership of any of our shares owned by them through short sales, option transactions or other derivative instruments.

We believe this further supports the alignment of the interests of our non-employee directors with those of our stockholders.

Our non-employee directors

also will be reimbursed for reasonable out-of-pocket expenses incurred in connection with their service on the Board and the Board committees. Employees of Greenhill who also serve as directors receive compensation for their services as employees, but they do not receive any additional compensation for their service as directors. No other compensation is paid to our Board members in their capacity as directors. Non-employee directors do not participate in our employee benefit plans. See discussion under

“Certain“Certain Relationships and Related Transactions—Related Transactions Involving our Directors and Executive Officers—Other Compensation”Compensation” for a description of the compensation paid to Robert F. Greenhill, who is the Chairman

Emeritus of our Board

of Directors and an employee of Greenhill, but is not an executive

officer.officer, and see discussion under “Compensation Discussion and Analysis” for discussion of the compensation paid to Scott L. Bok, our CEO and Chairman of our Board.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We recognize that transactions between us and any of our directors or executives can present potential or actual conflicts of interest or create the appearance that our decisions are based on considerations other than what is in the best interests of the firm and our stockholders. We also recognize that at times, such transactions may actually be in the best interests of the Company.

Related Person Transaction Policy

We have adopted a written related person transaction policy, which is administered by the Nominating and Governance Committee. This policy applies to any transaction or series of related transactions or any material amendment to any such transaction involving a related person and the Company or any subsidiary of the Company. For the purposes of the policy, “related persons” consist of executive officers, directors, director nominees, any stockholder beneficially owning more than 5% of the Company’s common stock, and immediate family members of any such persons. Under the policy, the transaction will be referred to the General Counsel, the

Chief Executive OfficerCEO and/or the Nominating and Governance Committee for review depending on the identity of the “related person.” Such reviewer will review, approve or ratify the transaction, taking into account all relevant facts and circumstances, including without limitation the commercial reasonableness, the benefit and perceived benefit or lack thereof, to the Company, the availability and/or opportunity costs of alternate transactions, the materiality and character of the related person’s direct or indirect interest, and the actual or apparent conflict of interest of the related person. No reviewer may participate in any review, approval or ratification of any related person transaction in which such reviewer or any of his or her immediate family members is the related person. All determinations by the

Chief Executive OfficerCEO or the General Counsel under the policy will be reported to the Committee at its next regularly scheduled meeting or earlier if appropriate.

Certain Relationships and Related Transactions

Involving Our Directors and Executive Officers

Robert F. Greenhill,

founder, Chairman

Emeritus, director and employee of the Company,

actively participates in various client revenue generating engagements as well as overall activities of the Firm.

Consistent with our practice for compensating our senior professionals, Mr. Greenhill was compensated in 2016 on a pay-for-performance basis based on his relative contribution to the Company. In

2016,2019, Mr. Greenhill received a total of

$3,045,828$628,164 in compensation, including a base salary of $600,000

$1,899,000and $28,164 in

restricted stock units awarded in 2016 (calculated by multiplying the number of shares underlying the award by the closing price of our common stockdividend equivalent payments on

the trading date prior to the grant date of the award) as well as Dividend Equivalent Payments and expenses of a car and driver.his outstanding equity awards. The cost of Mr. Greenhill’s car and driver was

$182,314$177,153 in

20162019 (comprised principally of compensation expense in respect of Mr. Greenhill’s driver, who is our employee).

In addition,Effective January 1, 2020, Mr.

Greenhill usesGreenhill’s driver is no longer an

aircraft owned by us for personal travel; Mr. Greenhill reimburses us for the costs associated with his personal useemployee of the

aircraft. See “Use of Corporate Aircraft” below. These perquisites are provided only to Mr. Greenhill, in recognition of his role as founder of our Firm.Company.

Similar to our arrangements with certain senior professionals, we have an employment agreement with Mr.

Greenhill that providesGreenhill. Through December 31, 2019, the agreement provided that he

willwould be paid an annual base salary of $600,000, subject to annual review by the Compensation Committee, and that he may be awarded a bonus in an amount to be determined in the sole discretion of the Compensation Committee.

Beginning on January 1, 2020, Mr. Greenhill became a Senior Advisor and his annual base salary was adjusted to $100,000. Mr. Greenhill is also entitled to participate in all of our employee benefit plans, including, without limitation, our group health, dental and life insurance plans, 401(k) Profit Sharing Plan and Equity Incentive Plan. The employment agreement may be terminated by either party on 90 days’ notice. Under the agreement, Mr. Greenhill is subject to limitations on his ability to compete with us during the term of his employment and for a three-month period thereafter. He is also prohibited from soliciting certain of our employees for a period of six months following the termination of his employment. In addition, he is subject to obligations of confidentiality and is required to protect and use confidential information in accordance with the restrictions placed by us on its use and disclosure.

Use of Corporate Aircraft

Through our wholly-owned subsidiary Greenhill Aviation Co., LLC, we own and operate an airplane that is used by our employees for transportation on business travel and by Robert F. Greenhill and his family for transportation on business and personal travel. We bear all costs of operating the aircraft, including the cost of maintaining air and ground crews. We have an aircraft expense policy in place that sets forth guidelines for personal and business use

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the

airplane. Mr. Greenhill reimbursesExchange Act and regulations of the

Company for the actual out-of-pocket costs associatedSEC require our directors, officers and persons who own more than 10% of our common stock, as well as certain affiliates of such persons, to file initial reports of their ownership of our equity securities and subsequent reports of changes in such ownership with the

operationSEC. Directors, officers and persons owning more than 10% of a registered class of our common stock are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. Based solely on our review of the

Company’s aircraftcopies of such reports provided by the reporting persons or their respective brokers and on information known to us regarding changes in

connection with the personal use thereof by Mr. Greenhill. In 2016, Mr. Greenhill reimbursed us $300,095 for such costs incurred in 2016. No other employees used the aircraft for personal travel in 2016.In addition, employees of Greenhill from time to time use airplanes personally owned by Mr. Greenhill for business travel. In those instances, Mr. Greenhill invoices us for the travel expense on termsownership, we believe are comparable to those we could secure from an independent third party. During 2016, we paid $9,771 to an entity controlled by Mr. Greenhill on accountthat our directors, officers and owners of such expenses.

Use of Hangar Space